Pennsylvania Advances CCS Framework, but Gaps Remain

A long-awaited bill has cleared the state Senate and is likely to be finalized before the end of the year.

The draft Carbon Capture and Sequestration Act is a crucial element of Pennsylvania’s plans to decarbonize the state economy, which include regional CCS and hydrogen hubs. Specifically, Tenaska, a Nebraska-based company, has proposed a Tri-State CCS hub across Pennsylvania, Ohio and West Virginia aimed at transporting and storing 5 million metric tons of CO2 per year. In addition, Pennsylvania is part of two regional hydrogen hubs: the Mid-Atlantic Clean Hydrogen Hub (MACH2) and Appalachian Regional Clean Hydrogen Hub (ARCH2). At least one of the hubs will produce blue hydrogen that will require the deployment of CCS infrastructure. Currently, Pennsylvania is lagging behind Ohio and West Virginia in terms of the development of the CCS framework, and the adoption of the CCS Act is likely to speed up existing regional initiatives. However, the proposed legislation fails to clarify several important issues, which could create obstacles further down the line.

Inside the draft legislation

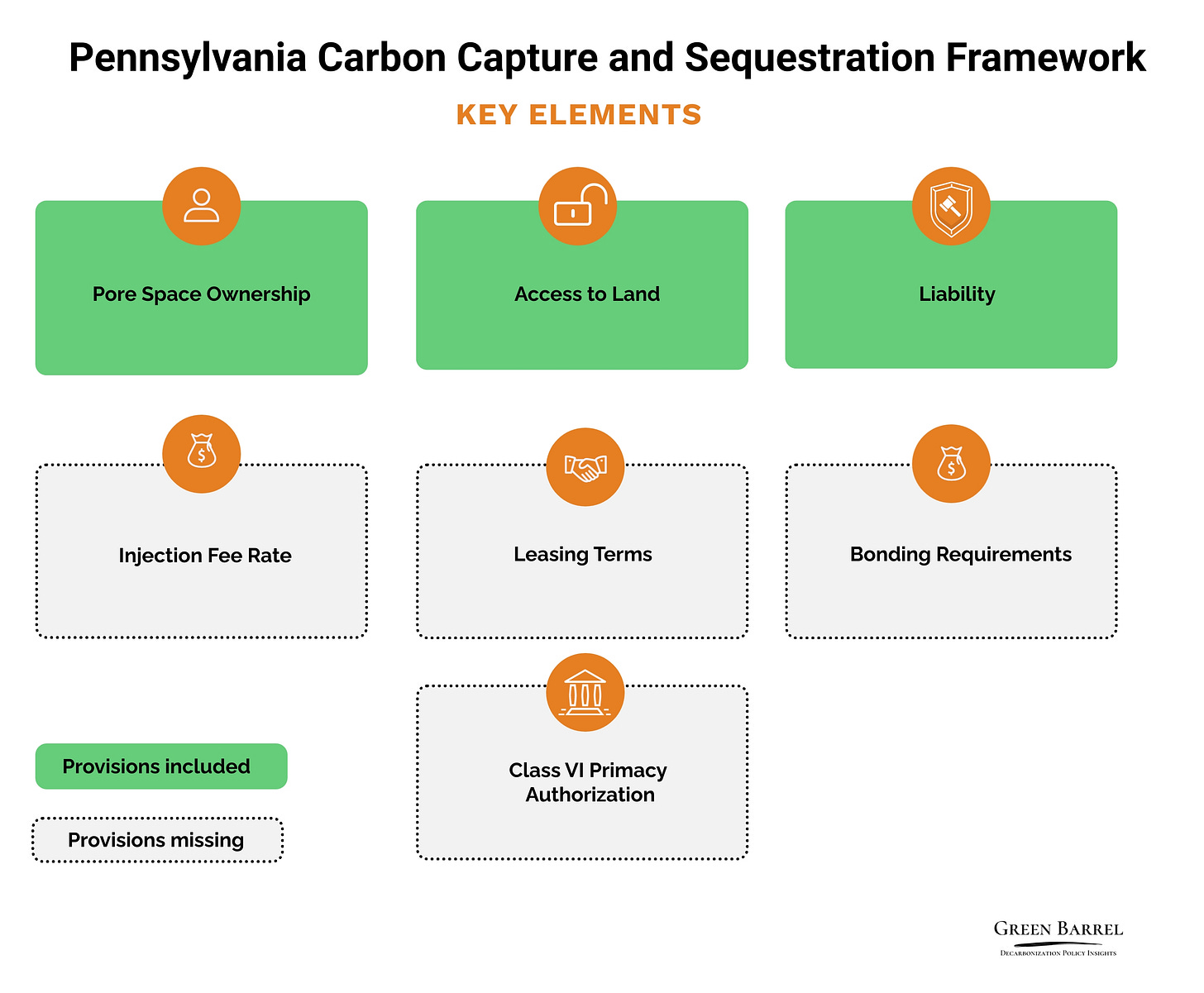

Pore space ownership, access to land and long-term liability are among the key elements of the CCS Act, which are also subject of public debates, particularly in the areas with proposed carbon storage projects. If the bill passes the state legislature in its current form, the risk of local community opposition and litigation is likely to be elevated.

Pore space. The ownership of all pore space in all strata below the surface lands and waters is vested in the surface property owner above the pore space. The legislation provides for the aggregation of non-consenting owners (or those that cannot be located). If the storage operator secures written consent or agreement from the owners of at least 60% of the ownership interest in the pore space for the storage facility, all of the pore space of the interests for which an agreement has not been reached would be included within the proposed storage facility via a collective storage order. Each nonconsenting or nonlocatable pore space owner would be entitled to compensation identified by the collective storage order. These provisions have already prompted backlash from activist groups concerned about a relatively low threshold of non-consenting owners (for example, Wyoming’s threshold is 80%). In February, WeConservePA, on behalf of its 75 member organizations, urged lawmakers to rewrite the draft and allow the construction of carbon transport and storage infrastructure only where landowners are willingly participating in such projects.

Access to land. If the storage operator is unable to negotiate with the surface owner for the right to conduct a seismic survey on lands owned by the surface owner, the Secretary of Environmental Protection may issue an order for the entry on the lands by the storage operator. In this case, the operator would be required to pay the surface owner just and reasonable compensation as determined by the Secretary. A similar mechanism would apply to seismic monitoring operations conducted for the purposes of identifying the risk of induced seismicity at the carbon storage site.

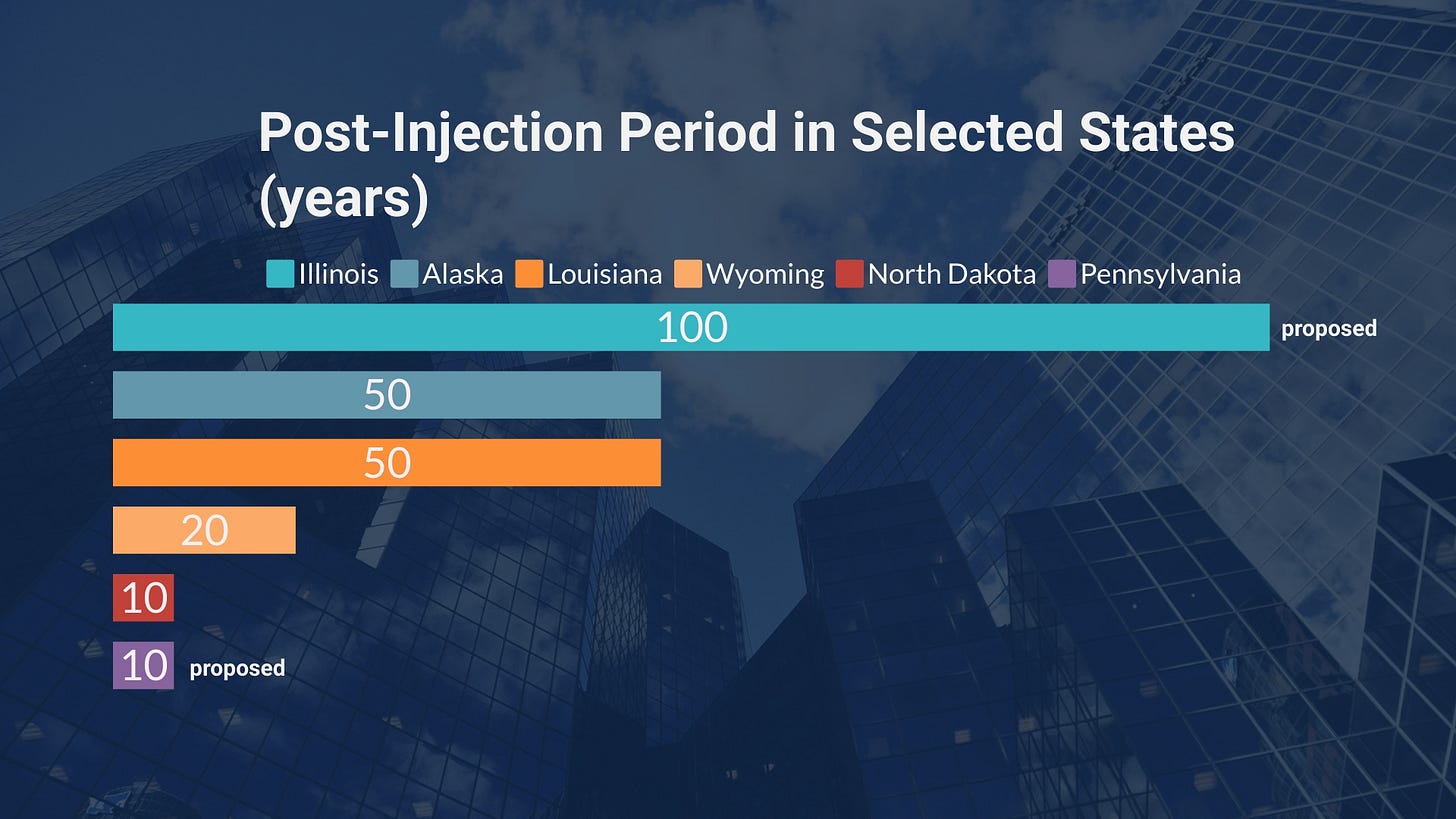

Liability. All carbon dioxide injected into the storage facility for sequestration purposes would be owned by the storage operator that would also be liable for any damages resulting from such activity. When injection ends, the storage operator would have to wait at least 10 years before applying for a certificate of project completion. While this is not an uncommon post-injection period, the opponents of the legislation have criticized it for being too short.

Missing pieces

Class VI primacy. The CCS Act does not contain an explicit authorization for the state regulator to seek primary authority over the underground injection control (UIC) program. Potential projects in Pennsylvania are likely to be disadvantaged compared to other states that have already applied or in the process of applying to the US Environmental Protection Agency (EPA) for Class VI primacy. Pennsylvania’s dependence on the federal permitting program could also act as drag on the proposed regional hub projects, forcing developers to seek CO2 storage opportunities in the neighboring states. In the tri-state region, only West Virginia has applied to the EPA, making it a potentially more attractive investment destination compared to Pennsylvania and Ohio.

Leasing terms. The draft legislation does not clarify the mechanism for the allocation of carbon storage acreage, including annual rental fees.

Injection fees. The bill requires the storage operator to pay an injection fee on a per ton basis, but specific amounts are yet to be determined by the Environmental Quality Board. The amount of the fee would be determined based on the anticipated expenses of the Board associated with regulating storage facilities during construction and operation and with managing and monitoring them following the issuance of the certificate of project completion. The provision would fuel additional uncertainty by leaving the fee rate at the discretion of the regulator. In Alaska, the state legislature has recently established specific fee amounts and detailed an adjustment formula aimed at creating a more stable environment.

Bonding requirements. The CCS Act does not require any financial guarantee to be provided by the storage operator before applying for a storage permit that would be released upon the issuance of the certificate of project completion. Such a guarantee could alleviate potential public concerns about the availability of funds in emergency situations and could also bolster the credibility of a project developer.

The House of Representatives would likely need to amend the proposed CCS Act to fill at least some of the gaps to facilitate the development of CCS projects over the near-to-medium term, especially Class VI authorization. The clarification of the financial terms would remove uncertainty for investors and could also help to win public support for CCS projects as local residents would be able to see the benefits of such projects.